- Shortlysts

- Posts

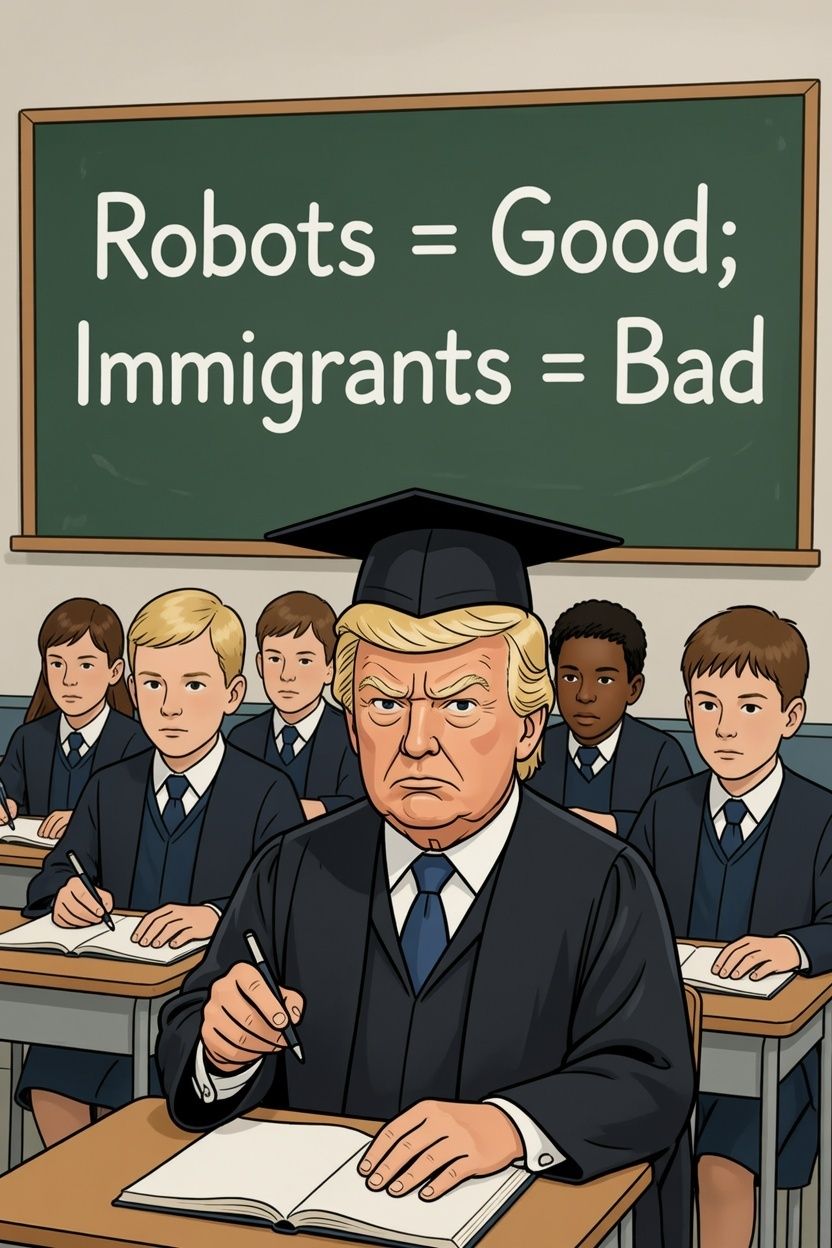

- Robots vs. Immigration: The Economic Clash at Davos

Robots vs. Immigration: The Economic Clash at Davos

President Trump challenges the global consensus on migration economics, advocating automation and productivity over population growth to sustain Western prosperity.

What Happened

President Trump delivered a pointed message at the World Economic Forum in Davos, Switzerland, arguing that mass migration is poor economic policy and that Western nations should pursue growth through automation and productivity rather than migration.

Speaking to an audience of European business leaders and policymakers, Trump outlined his administration’s first-year economic record, claiming it achieved low inflation and high growth while dramatically reducing immigration levels.

He contrasted this approach with what he characterized as the conventional Washington and European consensus favoring government spending, mass migration, and foreign imports as paths to economic expansion. The president stated that his administration removed over 270,000 federal bureaucrats in the past year, the largest single-year reduction in government employment since World War II.

The speech was a direct challenge to decades of economic orthodoxy among Western policymakers and business leaders. Trump argued that the traditional model of importing populations from developing nations to fill labor gaps has failed, pointing to what he described as unrecognizable changes in European cities and American communities.

He went on to advocate for an alternative vision centered on technological advancement, suggesting that the economy should rely on robotics and automation rather than on foreign workers. The president also connected immigration to housing affordability, arguing that border crossings drive up costs for young Americans trying to buy homes.

Why It Matters

Traditional economic models have generally viewed immigration as beneficial, providing workers for industries facing labor shortages, keeping wage pressures in check, and supporting tax bases as native populations age. Many economists point to historical waves of immigration as contributing to American economic dynamism and innovation.

$60M+ raised. 14,000+ investors. Valuation up 5,000%+ in 4 years*. Shares still only $0.85.

Backed by Adobe and insiders from Google, Meta, and Amazon, RAD Intel has its Nasdaq ticker ($RADI) reserved and a leadership team with $9 Billion+ in M&A transactions under their belt.

A who’s-who roster of Fortune 1000 clients and agency partners are already using their award-winning AI platform with recurring seven-figure partnerships in place.

Spotlighted in Fast Company, RAD Intel was described in a sponsored feature as “a groundbreaking step for the Creator Economy". Lots to like here; sales contracts have doubed in 2025 vs. 2024. Industry consolidation is exploding — 240 AI deals worth $55B in just six months.

Join early, diversify, and participate in RAD Intel’s upside today.

Own the layer everyone will build on.

However, a growing counter-argument suggests that relying on immigration allows businesses to avoid investing in productivity improvements, wage increases, and technological solutions that would benefit existing workers. It suggests that automation and higher wages create sustainable economic growth while immigration primarily benefits corporate profits at the expense of working-class wage stagnation.

The choice between immigration-driven growth and productivity-driven growth involves fundamental trade-offs that extend beyond economics into social cohesion, cultural integration, and community stability.

Both American and European communities are experiencing rapid demographic change and face challenges in their education systems, housing markets, and public services, which must adapt to new populations with diverse languages and cultural backgrounds. Support for immigration has waned in America and Europe, with many on both sides of the Atlantic calling for harsher policies.

How It Affects You

Should policymakers follow the automation-focused approach Trump outlined, you might see greater investment in technology to replace routine jobs across industries, from manufacturing to food service to transportation. This could mean fewer entry-level positions available but potentially higher wages for remaining jobs as labor becomes scarcer and companies must compete for workers.

Future career paths for Americans might require more technical skills to work alongside automated systems as opposed to competing with cheaper foreign labor, which could prove difficult for workers in industries facing rapid automation without clear pathways to new employment.

Reduced immigration could ease pressure on housing markets in areas that have experienced rapid population growth, potentially making homeownership more attainable for young families.

If America grows its economy by making each worker more productive rather than importing cheaper labor, wages could rise as employers compete for a smaller pool of workers. The trade-off is that Social Security faces demographic pressure without constant population growth, though supporters of automation argue that higher productivity generates more tax revenue per worker.

An economy built around robots and technology could deliver innovations that raise living standards across the board, or it could concentrate wealth among those who own the machines while displacing workers without providing them with new opportunities.

The question is not just about immigration numbers but about which path creates sustainable prosperity for working families rather than short-term gains for corporations seeking cheap labor, and that choice will define American economic life for generations.

*Disclaimer: This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Brand references reflect factual platform use, not endorsement. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.